vermont state tax return

Call 1-866-828-2865 toll-free in VT or 802-828-2865 local or out-of-statefor information on the status of your return and refund. E-File is not available for Vermont.

How To File A Renter Credit Claim In Myvtax Form Rcc 146 V4 Youtube

Vermont School District Codes.

. Personal check cashiers check or money order in person to. Vermont State Tax Refund Status Information. Checks can be cashed up to 180 days after the issue date.

Its top rate however is. However if you owe Taxes and dont pay on time you. Vermont State Parks Explore our state parks and immerse yourself in the beauty of Vermont.

You can check the status. Use a tax professional or volunteer assistance to prepare and file your return. Vermont State Parks Explore our state parks and immerse yourself in the beauty of Vermont.

File or Pay Online. Get an extension until October 15 in just 5 minutes. Direct Deposit is not available for Vermont.

133 State Street 1st Floor. Vermont State Income Tax Return forms for Tax Year 2021 Jan. The 2022 state personal income tax brackets are updated from the Vermont and Tax Foundation data.

State government websites often end in gov or mil. File My Federal Vermont State Returns. Taxes owed are still due on April 15 and interest will accrue on the balance as of April 16.

Non-resident VT state returns are available upon request. Box 1881 Montpelier VT 05601-1881. PA-1 Special Power of Attorney.

Ad Fill Sign Email VT SU-452 Form More Fillable Forms Register and Subscribe Now. Vermont income taxes are imposed on individuals and entities taxpayers that vary with the profitable income taxable income of the taxpayer. W-4VT - Vermont Tax Withholding Form.

Tracking your Vermont tax refund. Civil Marriage Quarterly Return Form. Separate taxes such as Income and Property Tax are assessed against each taxpayer meeting certain minimum criteria.

Lease Excess Wear Tear Excess Mileage Tax. You may submit all forms schedules and payments by. Checks can be cashed up to 180 days after the issue date.

Use myVTax the departments online portal to check on the filing or refund of your Vermont Income Tax Return Homestead Declaration and Property Tax Adjustment Claim Renter Rebate Claim and Estimated Payments. 31 2021 can be e-Filed along with an IRS Income Tax Return by the April 18 2022 due date. The basics of Vermont state tax Taxing body.

Pay Taxes Online File and pay individual and business taxes online. Electronic filing allows us to quickly and more accurately process your refund. Ad See How Long It Could Take Your 2021 State Tax Refund.

Vermont School District Codes. There is no evidence that e-filing contributes to identity theft. E-filing is also a secure way to file.

PA-1 Special Power of Attorney. Please wait at least three days before checking the status of your return on electronically filed returns and six to eight weeks for paper-filed returns. W-4VT Employees Withholding Allowance Certificate.

PUBLIC INFORMATION REQUESTS TO. Understand and comply with their state tax obligations. The Vermont Department of Taxes administers tax laws and collects taxes in the State of Vermont.

If you used direct deposit check with your bank for deposit information. Do I Need to File a Vermont State Tax Return. IN-111 Vermont Income Tax Return.

If you dont owe taxes or are expecting a Vermont tax refund you will need to use the address. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. You can also find answers to Vermont tax questions at the states individual income tax site.

The Vermont Department of Taxes offers several eServices for individual taxpayers and businesses through myVTax. This is because the software does the math for you and may catch errors such as omitting a Social Security Number or a signature which can slow processing time. Vermont Fish and Wildlife.

W-4VT Employees Withholding Allowance Certificate. Vermont School District Codes. Vermont State Tax Refund Status Information.

PA-1 Special Power of Attorney. IN-111 Vermont Income Tax Return. Preparation of a state tax return for Vermont is available for 2995.

If you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penalty. Call 1-866-828-2865 toll-free in VT or 802-828-2865 local or out-of-statefor information on the status of your return and refund. B-2 Notice of Change.

Before sharing sensitive information make sure youre on a state government site. Office of the State Treasurer 109 State Street Montpelier Vermont 05609 Main Phone. To document additional taxes collected as a result of excess wear and tear andor excess mileage at the end of a motor vehicle lease contract.

PUBLIC INFORMATION REQUESTS TO. The departments general information number is 1-802-828-2505. Click Here - For Public Records Database.

Download Or Email Form HS-122 More Fillable Forms Register and Subscribe Now. 802 828-2301 Toll Free. Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are based on Vermonts 2021 income tax brackets.

To apply for a lesser tax due at the time of registration when disagreeing with NADA value. Submit Your Return in Person. IN-111 Vermont Income Tax Return.

802 828-2301 Toll Free. Vermont tax forms are sourced from the Vermont income tax forms page and are updated on a yearly basis. E-Filing non-resident VT state returns is not available.

W-4VT Employees Withholding Allowance Certificate. FY2023 Property Tax Rates. Vermont Municipal Equipment Loan Fund Application.

Vermont Form IN-111 - Vermont Individual Income Tax Return Vermont Schedule IN-112 -. Vermont State Tax Extension. Allow up to 8 weeks for processing time.

Fact Sheets and Guides. Vermont Department of Taxes. Tax Return or Refund Status Check the status on your tax return or.

To file for a state extension you use a form IN-151 to the DOT. Ashlynn Doyon at treasurersofficevermontgov. If you are a full or part-time resident of Vermont you earn more than 100 from a Vermont source or sources and you are required to a file a.

Sign Up for myVTax. All Forms and Instructions. Our office hours are 745 am.

For returns filed by paper. 109 State Street Montpelier Vermont 05609 Main Phone. Like many other states Vermonts state income tax is progressive.

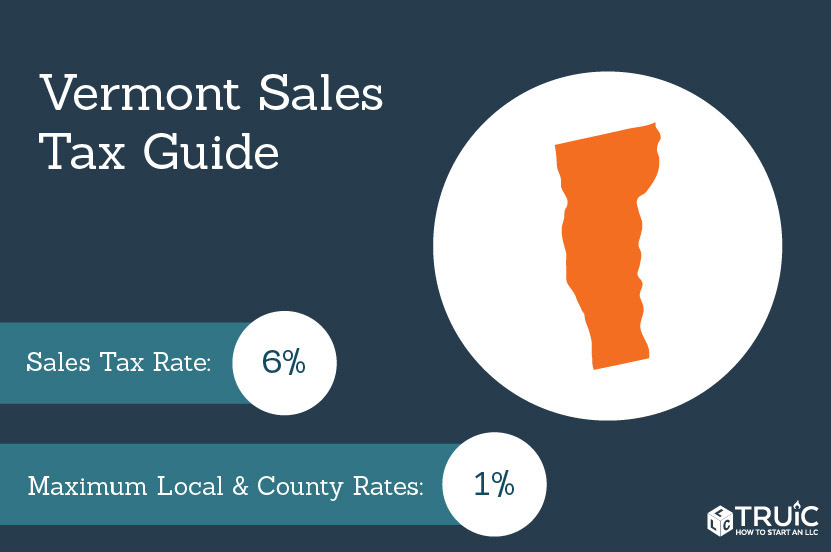

Vermont Sales Tax Small Business Guide Truic

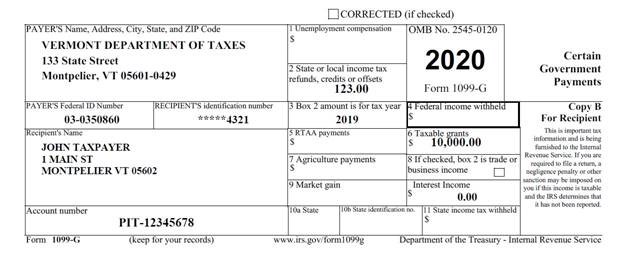

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Follow Vt Dept Of Taxes S Vtdepttaxes Latest Tweets Twitter

Follow Vt Dept Of Taxes S Vtdepttaxes Latest Tweets Twitter

Follow Vt Dept Of Taxes S Vtdepttaxes Latest Tweets Twitter

Personal Income Tax Blows Past Projections By Over 117 Million In April Vermont Business Magazine

Where S My State Refund Track Your Refund In Every State

State Corporate Income Tax Rates And Brackets Tax Foundation

Where S My Refund Vermont H R Block

Tax Year 2021 Personal Income Tax Forms Department Of Taxes

Vermont Department Of Taxes Notice Of Changes Sample 1

Personal Income Tax Department Of Taxes

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Follow Vt Dept Of Taxes S Vtdepttaxes Latest Tweets Twitter

Personal Income Tax Department Of Taxes

Complete And E File Your 2021 2022 Vermont State Tax Return

2022 Tax School Education Programs Uvm Extension Cultivating Healthy Communities The University Of Vermont