postmates tax form online

This means you can deduct non-commuting business mileage. In this Video I try my best to explain Postmates taxes.

Postmates Taxes 101 Filing Postmates Taxes For The End Of The Year Youtube

I dont even run deliveries for them anymore because I make more money on other platforms and they have changed so much in the last year that I dont.

. Since taxes arent withheld from your Postmates income its possible you need to pay taxes quarterly. Yes Uber Eats also offers promotions to delivery people using the platform. With Postmates Unlimited you get free delivery with no blitz pricing or small cart feesever.

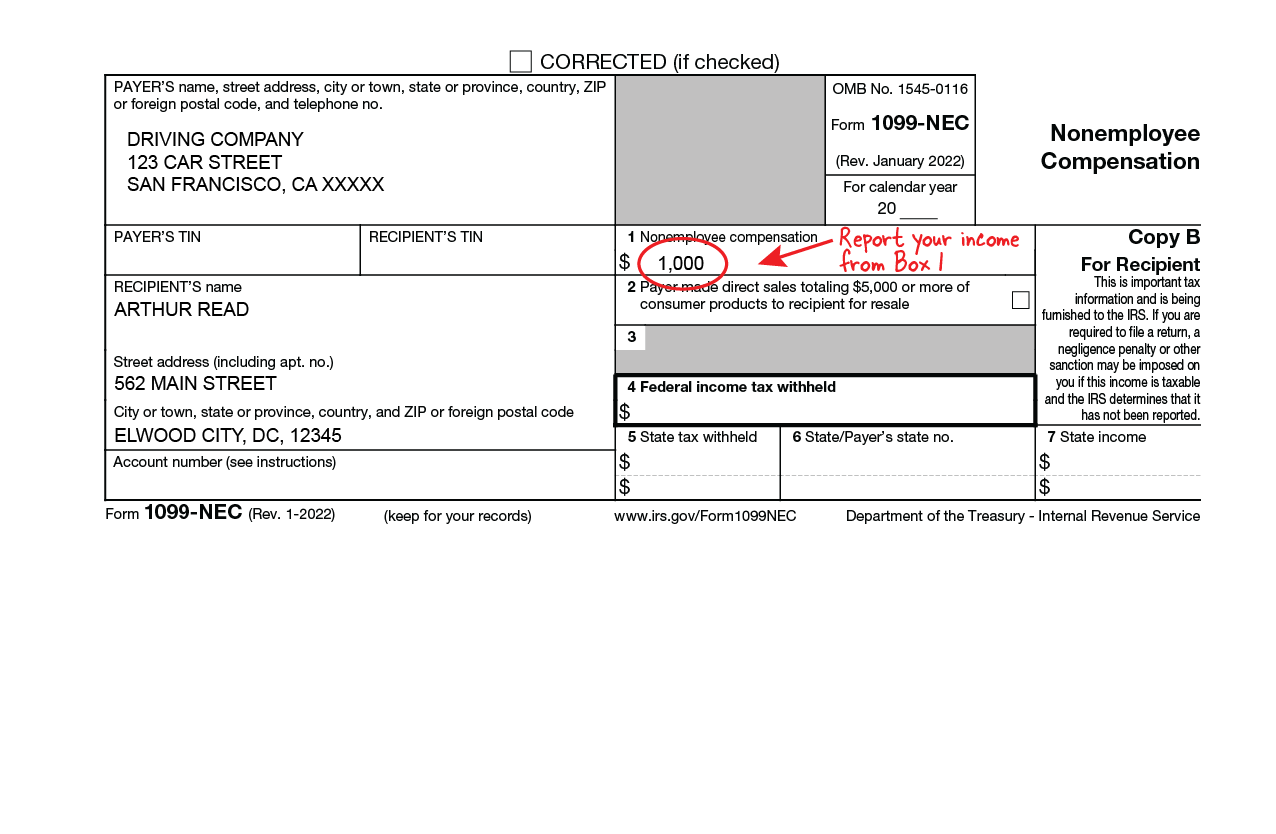

This is what they said. These forms are very similar in the information they give you and if you follow the tax forms they will be really easy to enter. If they didnt they will have a tax information for that will tell you exactly what you made.

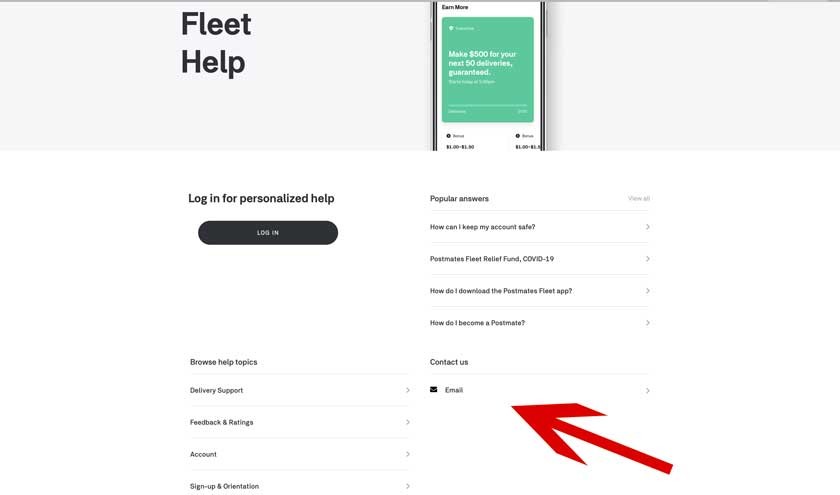

Combining this percentage with your federal and state taxes can be alarming. This is where you enter your earnings from Grubhub Doordash Uber Eats and others. Since Postmates has been acquired by Uber youll need to reach out to Uber for your 1099.

Unlimited free deliveryonly for Unlimited members. Then from there you can click on Tax Documents and if they did a 1099 for you you can download it there. Self-Employed defined as a return with a Schedule CC-EZ tax form.

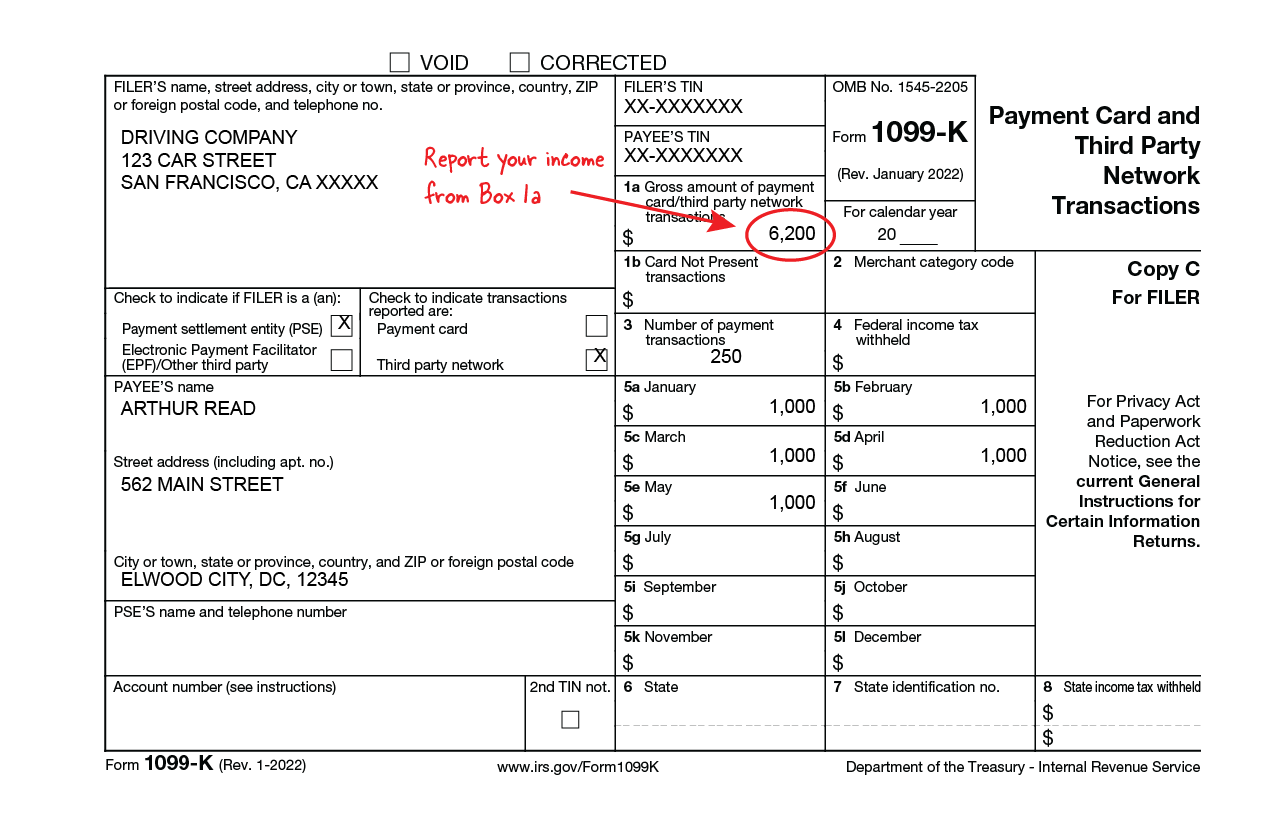

IRS Tax Forms For A Postmates Independent Contractor. Independent contractors are generally considered self-employed and report profits and losses on form 1040 Schedule C. According to Postmates if you dont meet this requirement.

TT will ask you for other sources of income in its interview with you. The best way to figure out if you owe quarterly taxes is to fill out Form 1040-ES or use an online tax calculator to estimate how much income youll have this year and how much youll owe in taxes. Posted by 4 years ago.

12200 if under age 65. This includes the miles you drive with your car for your delivery drivers including delivery pickup. Instacart does not offer any discounts with any tax services.

It also includes your drive back home when you are finished working for the day. A 1099 form is an information return that shows how much you were paid from a business or client that was not your employer. As an independent contractor you will have to file your FICA taxes both as the employee and the employer which totals 153.

Doordash is a different animal. You dont have to file. From how to pay your postmates taaxes to what write offs you can claim with postmates.

As a Postmates independent contractor you are responsible for keeping track of your earnings and accurately reporting them in tax filings. Americas 1 tax preparation provider. PostmatesUber Tax Form 1099 Help.

There are many IRS 1099 forms but our guide will only review the most relevant ones for your Postmates taxes. At this time 2021 1099-Forms are not available. Also theres a link to a DocuSign agreement document youll need to sign.

IRA Tax Forms for All Types of Less - Used Tax Forms. Need help contacting Postmates for my 1099 to file my taxes. However if you have other income over 12200 from another source of income then just add the 25 as an additional source of income.

Therefore if that 25 is the only income you have. If you make less. In the email they will tell you to arrive 5-10 minutes early as late applicants will not be admitted.

As gig workers all of our money is. TurboTax will also add Schedule SE which. Postmates online application.

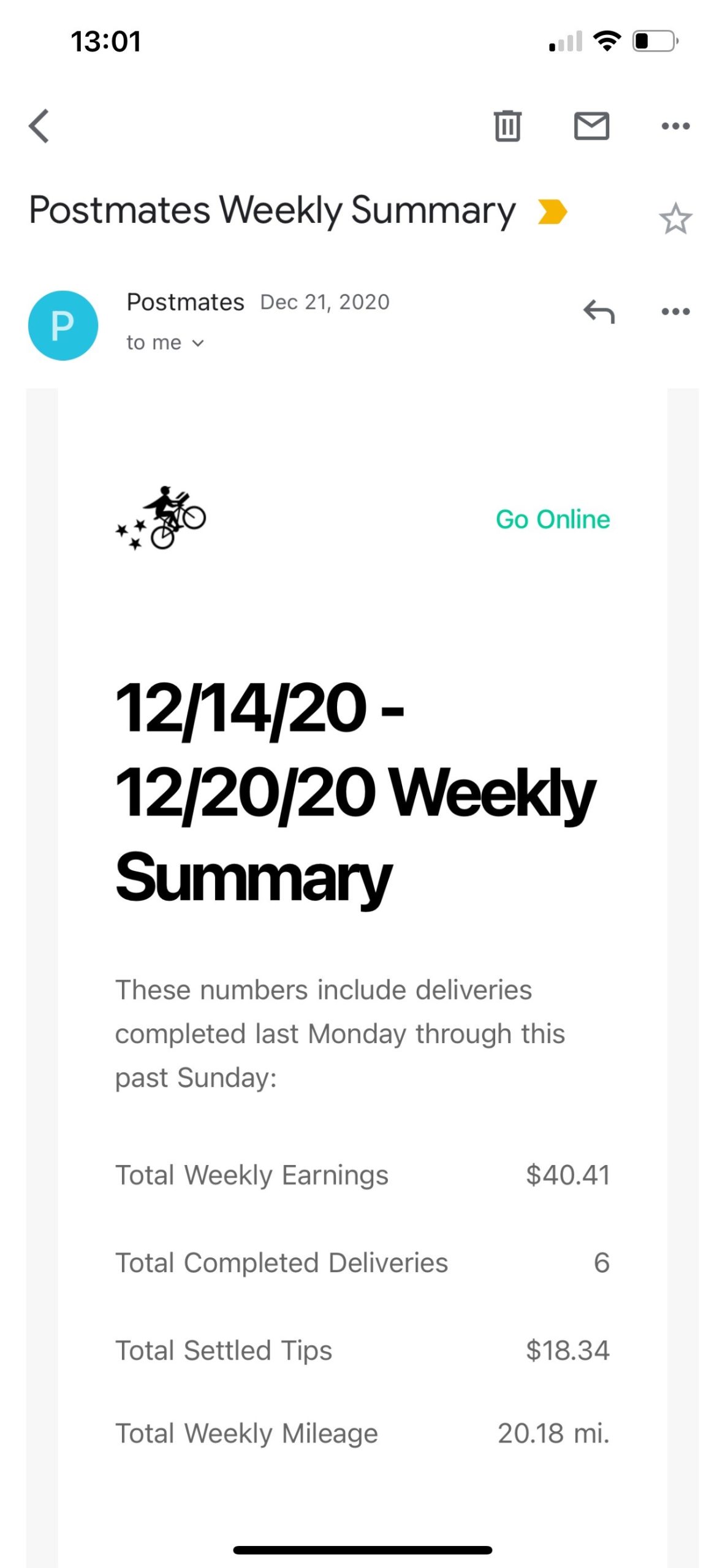

As a Postmates delivery driver youll receive a 1099 form. If youre driving for Postmates full-time make over 20000 and do 200 or more deliveries youll receive a 1099-K. Open the Driver app Tap Menu icon Tap Earnings Tap Promotions.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. While Stride operates separately from Postmates I can tell you that Postmates will only prepare a 1099-MISC for you if. Here you will add up how much money you received for your delivery work.

If you have earned 600 or more on the platform in 2021 then a 1099-NEC form will be made available to you in early 2022. Single filing status. Get help with your Uber account a recent trip or browse through frequently asked questions.

You can keep up to date on active and upcoming promotions by following these steps. As a Postmates driver youre self-employed. Try it free with a 7-day free trial cancel anytime.

After I applied I got an e-mail telling me to schedule myself for an onboarding session. Fortunately you are allowed to write off the employer portion which is 765 in the year 2020. I completed the Postmates application online.

Promotions vary from week to week based on customer trends and app usage in your city. Your earnings exceed 600 in a year. As 1099-NEC forms provide annual income and the tax year is not completed yet the form has not been created at this time.

So if you have determined that you are a contractor you can always call and ask Postmates then you will have to file a Schedule C on your tax return in TurboTax this is the Self-employed version or Home Business. 1 online tax filing solution for self-employed. Ad Free software fills out tax forms IRS free file program participant.

Who and how do I contact them to at least get an electronic copy of it so I can file my taxes. On Schedule C you will be able to show your income as well as your expenses. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

If you earned more than 600 youll receive a 1099-NEC form. If you delivered for multiple delivery platforms and received multiple 1099 forms you add all that money up and enter the total income on Line 1.

How To Get Your 1099 Form From Postmates

4 Easy Ways To Contact Postmates Driver Customer Support

The Ultimate Guide To Taxes For Postmates Stride Blog

Postmates Taxes The Complete Guide Net Pay Advance

.png)

Postmates 1099 Taxes The Last Guide You Ll Ever Need

The Ultimate Guide To Taxes For Postmates Stride Blog

No 1099 Yet Can I Seriously Only Contact Them Via Email R Postmates

The Ultimate Guide To Taxes For Postmates Stride Blog

Postmates 1099 Taxes Your Complete Guide To Filing

Postmates Taxes The Complete Guide Net Pay Advance

Postmates 1099 Taxes The Last Guide You Ll Ever Need

How Do Food Delivery Couriers Pay Taxes Get It Back

How To Get Your 1099 Form From Postmates

How Do Food Delivery Couriers Pay Taxes Get It Back

Quarterly Tax Payment For Doordash Grubhub Drivers Entrecourier

Postmates Driver Requirements 2021 Review Background Check

How Do Food Delivery Couriers Pay Taxes Get It Back